Legislative developments to "propel" demand and competition

Contact

Legislative developments to "propel" demand and competition

Colliers International Myanmar Quarterly Review Yangon Retail Q2 2018 reveal that recent legislative developments show a promising sign that demand may be driven towards a lengthy upcycle.

Colliers expects the retail market to continually propel in the succeeding years. Especially with the recent legislative developments, we see this as a promising sign, driving demand towards a lengthy upcycle. Tenancy mixes are likewise seen to become more diverse in the next three years as new legislative efforts allow for more competition.

Overall, this much-welcomed liberalisation should strongly facilitate investment in retail and wholesale activities in Yangon going forward.

Forecast at a glance:

- Demand: Colliers thinks that further liberalisation of restrictions for foreign trading should fuel demand in the succeeding years.

- Supply: Supply continues to grow as an integrated part of future mixed-use developments. Colliers estimates an additional 36,000 sqm of retail space in the next three years. However, regional size and destination shopping malls remain very limited.

- Occupancy rate: Occupancy rate remain healthy for the majority of well-maintained and well-positioned developments. Occupancy levels are still seen to register at 90% and above, at least in 2019-2020.

- Rent: Given the anticipated increase in new supply, rental levels are likely to become competitive in H2 2018. Rents should gradually increase in the next two years as new supply declines.

Retail integration to further drive supply

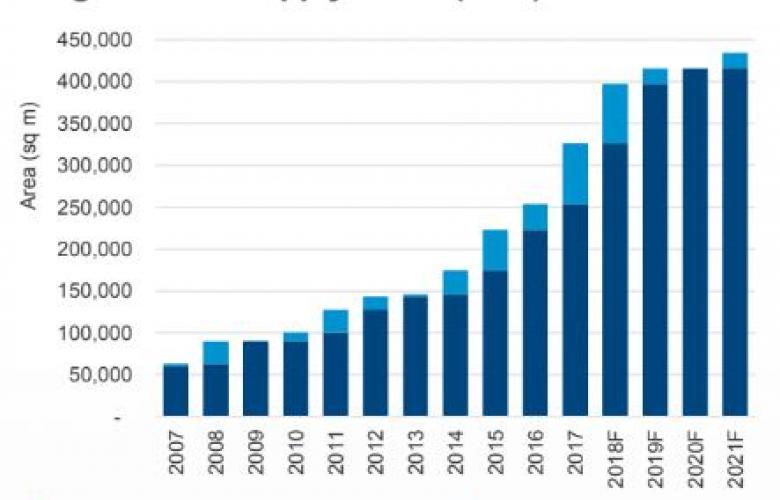

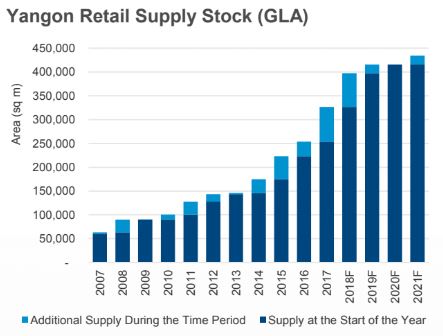

The report shows that retail stock continues to grow, led by projects integrated with residential, commercial, and mixed-use developments. During the first half of 2018, the considerable rise in supply was mainly driven by the increase in these supporting retail components. In Q2 2018 alone, additional supply came exclusively from retail components amounting to more than 4,000 sqm of leasable space.

Total supply at the end of the quarter totalled almost 348,000 sqm (3,745,841 sqft).

Source: Colliers International Myanmar

Upcoming supply for the remainder of the year is scheduled to reach close to 49,000 sqm (527,432 sqft), coming from:

- Kantharyar Shopping Mall (Asia Myanmar Shining Star Investment Company Limited),

- The One Shopping Mall (Creation Groups of Company Limited),

- Fortune Plaza (Excellent Fortune Development Group).

In the next three years, Colliers expects at least an additional 37,000 sqm (398,264 sqft) of new supply, all of which are still the retail components of larger developments include:

- Yadanar Mall (Time City)

- Kantharyar Shopping Mall (Kantharyar Complex)

- Yoma Central Retail (Yoma Central)

The bulk of additional supply is located in the Inner City Zone, with only two projects - The Secretariat Retail (Anawmar Art Group) and Yoma Central Retail (Yoma Land) - planned in Downtown.

As more developments are completed, and as competition rises, international standard quality is likely to be the norm.

Colliers recommends developers continually adopt new and innovative global retail concepts.

They also emphasise the need for open and public spaces capable of being animated through events, programs, and activities; with the ability to promote social ties and encourage public interaction.

Colliers sees robust yet untapped demand for large-scale lifestyle-oriented shopping malls, however, the supply remains limited. Creating destination retail establishments geared towards recreation and entertainment will bode well in the market and appears to be an attractive offering to many locals.

Click here to view Colliers International Myanmar Quarterly Review Yangon Retail Q2 2018.

For more information or to discuss the report, phone or email Karlo Pobre Deputy Managing Director or The Htet Oo, Manager for Research and Advisory for Colliers International Myanmar via the contact details listed below.

Similar to this:

Turning point expected in Mandalay property market

Colliers reveal key statistics from across Myanmar's property market

Significant foreign investment in Myanmar continues to boost demand - Colliers