Average occupancy and rental rates increase in Q2 2018

Contact

Average occupancy and rental rates increase in Q2 2018

Karlo Pobre, Deputy Managing Director for Colliers International Myanmar and Paul Ryan Cuevas, Analyst for Research, Valuation and Advisory of Colliers International Myanmar present the findings of Yangon Serviced Apartment Market Quarterly Report Q2 2018.

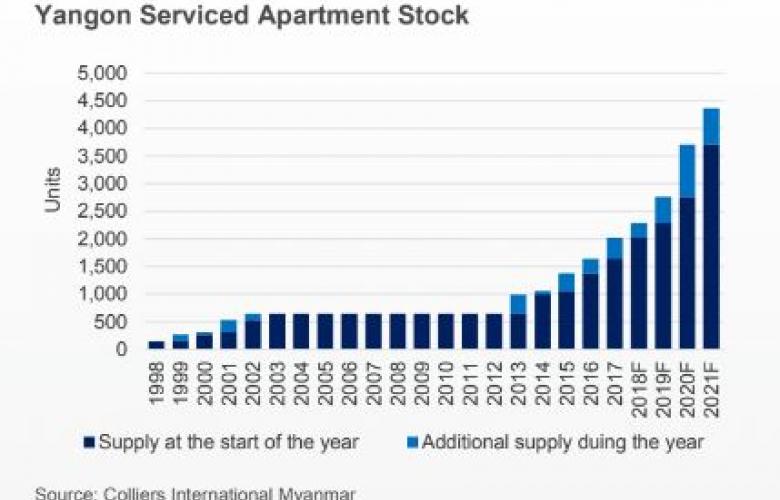

For the past three quarters, no new projects were introduced. However, a slight uptick in stock was recorded. This was mainly driven by renovations and expansion done by existing serviced residences.

As a result, both the average occupancy and rental rates increased in Q2 2018.

Going forward, while future supply remains skewed towards the upscale segment, Colliers International Myanmar recommends developers focus more on the underserved lower tier category by providing international quality limited service or non-serviced apartments.

Forecast at a glance:

- Demand: Colliers expect strong future demand for limited-service apartments that provide fewer facilities by are still considered good-quality accommodation.

- Supply: Yangon's future serviced apartment room stock should remain limited until Q4 2018. However, Colliers expects the total supply to double in the next three years.

- Occupancy Rate: The citywide occupancy rate settled at 83.7%, up by 2.7% QOQ. Colliers project occupancy to hover between 80% and 90% following the influx of new stock slated for completion between 2019 and 2021.

- Rent: Modest increases were recorded for one-bedroom, two-bedroom, and penthouse configurations, ranging between 1% and 3% QOQ. Colliers anticipate rental rates to settle at competitive levels with supply in the coming years.

Strong prospects for mid-tier projects remain unrealised

The report reveals that no new serviced apartment projects were completed in the past three quarters. Since Q4 2017, the total supply has been unchanged at more than 2,000 rooms.

Due to the limited construction progress observed, some developments, that were scheduled to be unveiled during H1 2018 were pushed further back to an unspecified period.

This leaves Lotte Serviced Apartment and Northern Inya Serviced Apartment as the latest completed projects, together with the expansion and renovations of existing developments like the Clover Suite Royal Lake, SOHO Diamond, and Sakura Residences 1.

Presently, the bulk of total supply is still found in the Inner City Area (75%), while the rest is positioned in the Outer City Area (25%). The supply share in the Outer City area improved significantly in H2 2017 following the completion of Lotte Serviced Apartments, which represents roughly 16% of the total current stock.

Meanwhile, the future introduction of Sedona Suites from Junction City means a return of supply in Downtown.

Source: Colliers International Myanmar

Over the course of two decades, the aggregate supply grew at a compounded annual growth rate of 15% and is scheduled to escalate to an annual growth rate of 16% in the next three years.

In fact, around 11 projects are scheduled to be completed between 2018 and 2021, translating to more than 2,300 new rooms.

However, upcoming developments for the remainder of the year are limited with only Kantharyar Serviced Residences and the extension of Clover Suite Royal Lake set to be completed, collectively representing more than 220 rooms.

While the serviced apartment market is in the process of taking shape in Yangon, Colliers' report observes that both existing and future stock remains significantly lower than in Myanmar's neighbouring ASEAN countries.

In fact, Yangon's current and future stock is much lower than neighbouring Bangkok's cumulative stock of almost 20,000 units despite having similar populations.

In the next three years, the market should witness additional further supply as developers rush to accommodate the increasing market demand.

However, lower-tier developments are likely to be preferred by tenants with price remaining a key consideration for expats.

Click here to view the Colliers International Myanmar Quarterly Review: Yangon Serviced Apartment Q2 2018.

For more information or to discuss the report, phone or email Karlo Pobre, Deputy Managing Director of Colliers International Myanmar or Paul Ryan Cuevas, Analyst for Research, Valuation and Advisory of Colliers International Myanmar via the contact details listed below.

Similar to this:

Legislative developments to "propel" demand and competition

Significant foreign investment in Myanmar continues to boost demand - Colliers